Are you ready to buy a home? One of the first steps is to get preapproved for a mortgage. It’s important to understand the documents needed for a preapproval, as well as what it takes to obtain one. In this blog post, we’ll discuss how to get a mortgage preapproval and explain why it’s so important. We’ll also cover market conditions, credit scores, 2-1 rate buydowns, and more.

What Is Prequalification vs Preapproval?

Prequalification is an estimate of how much you can borrow based on your income and other financial information that you provide lenders with. On the other hand, preapproval means that after looking at all of your documents (including tax returns), lenders are willing to lend you up to a certain amount for your loan. The key difference here is that while both processes involve evaluating whether or not someone qualifies for financing, only with preapproval does the lender actually commit funds towards the purchase price of a property if approved by underwriting guidelines.

Get into the right mortgage for you.

How To Get A Mortgage Preapproval:

- Start by gathering all necessary documents such as pay stubs from last two years; W2 forms; bank statements; proof of any additional income sources like rental properties or investments; copies of recent utility bills; divorce decree (if applicable)

- Contact your lender – compare rates & terms offered before deciding which one best suits your needs/budget constraints

- Submit application along with required documentation – this will help determine if there are any issues that need addressing prior approval being granted

- Once approved by lender, they will issue an official preapproval letter stating maximum loan amount available based on their assessment criteria

Credit Scores:

Your credit score plays an essential role when applying for loans in general but especially when seeking out mortgage financing options specifically because these types of loans tend be larger sums than most other types (e.g., auto loans). A higher score indicates better creditworthiness which makes obtaining favorable terms easier since lenders view borrowers favorably who possess good ratings according their standards set forth by FICO® scoring system used throughout industry today . Generally speaking though anything above 680 should suffice however depending upon individual situation may require higher numbers due various factors such type property being purchased or size down payment made etc.

2-1 Rate Buydown:

This refers process whereby borrower pays extra money upfront order lower interest rate over life loan term thus reducing monthly payments associated said agreement . For example , let’s say have 30 year fixed $200K mortgage 5% APR then decide want reduce principal balance $190K instead paying full amount owed each month could opt make lump sum payment equal 1% total ($2000 ) at closing time thereby lowering APR 4%. This would result saving approximately $50 per month during course entire duration contract making more affordable long run plus benefit having less debt overall too!

Market Conditions:

Currently buyers market meaning prices homes relatively low compared historical averages so now great time start shopping around even before officially apply loan . Doing helps give better idea what kind budget should expect working within allowing create realistic expectations regarding potential purchases without worrying about getting stuck something cannot afford later date . Knowing limits ahead allows focus attention properties fit into them rather wasting energy looking ones outside range right away – saves valuable time effort !

Benefits Of Preapprovals:

Having a preapproval gives added confidence when submitting offers sellers knowing have backing financially needed close deal quickly easily once accepted . Additionally , many times stronger offer comes from buyer whose finances already verified opposed those still waiting hear back from lender(s). Being able put foot forward shows commitment seriousness intentions further strengthens position negotiations table giving edge over others vying same property ultimately making seller more willing work them achieving desired outcome faster smoother fashion everyone involved!

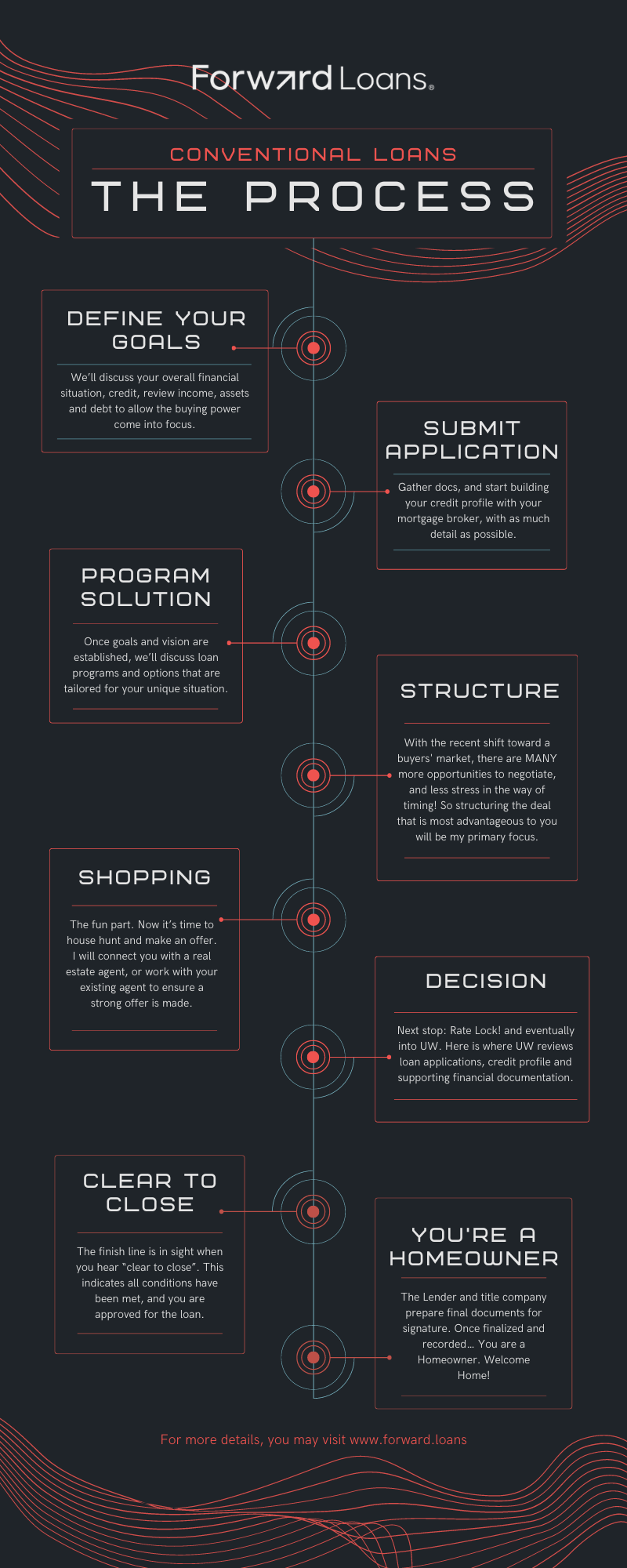

CONVENTIONAL LOANS

A Conventional Mortgage is a type of home loan that is not insured or guaranteed by the government. This type of mortgage requires the borrower to put down a larger down payment than other types of mortgages and typically has stricter credit requirements.

Qualifying factors for a conventional mortgage may include a good credit score, sufficient income, adequate assets, and proof that you can afford monthly payments on your new loan. Generally speaking, lenders will look at your debt-to-income ratio (DTI) when evaluating whether you qualify for a loan; this ratio compares how much income you make each month versus how much debt you owe each month.

The higher your DTI ratio is above 43%, the less likely it is that you’ll be approved for a loan until some changes are made such as paying off existing debts or increasing your income level so that it offsets any additional debt incurred from taking out an additional loan like a mortgage.

There are several different types of conventional mortgages available depending on what kind of homebuyer needs they meet: fixed rate vs adjustable rate; 15 year vs 30 year term; jumbo vs conforming.

Fixed rate mortgages

offer predictable monthly payments over their entire life while adjustable rate ones start with lower rates but can change after an initial period based on current market conditions – meaning there could be both upsides & downsides compared to locking into one specific interest rate over time if markets move significantly either way during its life cycle.

Jumbo loans

exceed limits set by Fannie Mae & Freddie Mac (the two main sources financing most residential real estate purchases) while conforming ones stay within these limits allowing them access better terms due their increased liquidity/demand in secondary markets where they’re sold off after origination.

Lastly 15 year terms provide faster payoff times since principal balances get paid quicker but also come with higher monthly payments due shorter amortization periods whereas longer 30 year options reduce overall costs associated borrowing funds since interest accrues slower even though total principal balance gets paid back later too!

Michael Creel is a veteran in the marketing industry, with a proven track record of helping brands in the real estate and lending space build a strong presence across a number of social platforms.

He’s built and implemented several marketing strategies and installed the digital and social framework to support several mortgage teams, loan officers, realtors, multiple new home builders as well as various brands in other spaces.

In 2020 Michael opened Forward Loans, a duly licensed mortgage brokerage, offering digital strategies and marketing automation to loan officers, while focusing on process and service for clients and employees.