What Is A VA Loan?

A VA loan is a type of mortgage loan available to eligible veterans, active-duty service members, and their spouses. The loan is guaranteed by the Department of Veterans Affairs (VA) and is offered through private lenders, such as banks and mortgage companies.

Common Types Of VA Loans

The most common types of VA loans are the 30-year fixed-rate mortgage and the 15-year fixed-rate mortgage. Other VA loans include adjustable-rate mortgages (ARMs), hybrid ARMs, VA jumbo loan, and VA-backed adjustable-rate mortgages.

Get into the right mortgage for you.

How Does A VA Home Loan Work?

A VA home loan works by providing eligible veterans, active-duty service members and their spouses with a loan guaranteed by the Department of Veterans Affairs. The VA does not provide the loan directly, but rather guarantees a portion of the loan to help lenders reduce their risk.

6 Easy Steps to Apply for a VA Loan

- Check Eligibility: The first step to applying for a VA loan is to check your eligibility. You must be an active-duty military service member, veteran, reservist, or National Guard member in order to qualify for a VA loan.

- Gather Required Documents: Once you have determined that you are eligible for a VA loan, you will need to gather the necessary documents to apply. This includes information about your income, assets, debts, and credit history.

- Find a Lender: The next step is to find a lender that is able to provide VA loans. You can use the Department of Veteran Affairs’ website to search for VA-approved lenders.

- Submit an Application: Once you have found a lender, you can submit an application. The lender will review your application and determine if you meet their requirements.

- Get an Appraisal: The lender will order an appraisal of the home that you are looking to purchase. This appraisal will be used to determine the home’s value.

- Finalize the Loan: If the lender approves your loan application, you will need to sign the loan documents and finalize the loan.

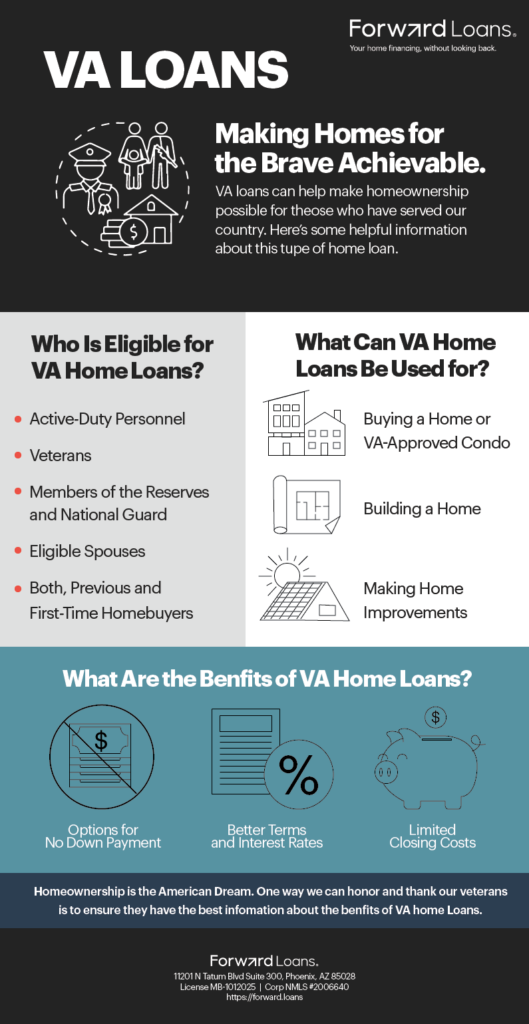

Who Qualifies For A VA Loan?

Veterans, active-duty service members and their spouses may be eligible for a VA loan if they meet certain criteria. To qualify, you must have served in the active military, naval, or air service and have been discharged or released under conditions other than dishonorable. Additionally, you must meet certain income and credit requirements.

How Does A VA Home Loan Work?

A VA home loan works by providing eligible veterans, active-duty service members and their spouses with a loan guaranteed by the Department of Veterans Affairs. The VA does not provide the loan directly, but rather guarantees a portion of the loan to help lenders reduce their risk. The loan is then issued by a participating lender, such as a bank or mortgage company.

VA Loan Rates

VA loan rates may vary depending on the lender, but in general, they are typically lower than conventional loan rates. VA loan rates are often lower than conventional loan rates because the VA guarantees a portion of the loan, which allows lenders to offer more competitive rates.

VA Loan Eligibility Requirements: Documents You’ll Need In order to apply for a VA loan

You will need to provide certain documents to your lender. These documents may include: a valid government-issued photo ID, proof of income, bank statements, Social Security number, and a Certificate of Eligibility (COE). Additionally, you may need to provide a copy of your DD Form 214, which is a document issued by the military upon discharge or retirement.

What Is A DD Form 214?

A DD Form 214 is a document issued by the military upon discharge or retirement. The form contains information such as your military service record, awards and decorations, and other pertinent information. The DD Form 214 is an important document needed to apply for a VA loan, and it is important that you keep a copy of this form for your records.

Other VA Loan Eligibility Requirements

In addition to the documents listed above, there are a few other eligibility requirements you must meet in order to qualify for a VA loan. These include:

- Property Type: The property must be a single-family home, a townhome, a condo, or a multi-unit home with up to four units.

- Credit Score: Most lenders require a minimum credit score of 620.

- Income: Your income must be stable and sufficient enough to cover the loan payments.

- VA Loan Limits: There are limits to the amount of money you can borrow with a VA loan.

- Down Payment and Assets: You are not required to make a down payment. However, you may need to provide proof of assets such as savings or investments.

- Funding Fee: There is a funding fee associated with a VA loan.

- Reserve Funds: You must have sufficient reserves to cover at least two mortgage payments.

Get into the right mortgage for you.

Loan-to-value Ratios

A 100% loan to equity value is a type of VA loan that allows borrowers to borrow up to the full value of the home without having to make a down payment. This type of loan is ideal for veterans who do not have the funds available to make a down payment.

The VA guarantees the loan up to 100% of the home‘s value, and the borrower pays only the interest on the loan. Additionally, VA loans typically have lower interest rates than VA loans do not require Private Mortgage Insurance (PMI). PMI is typically required by lenders when a borrower’s down payment is less than 20% of the home’s purchase price.

VA loans are backed by the U.S. Department of Veteran Affairs, which provides a guarantee to lenders that if the borrower defaults on the loan, the VA will pay the lender the difference between the loan balance and the sale price of the home. Because of this, lenders do not require PMI, allowing veterans to obtain financing with no down payment and no PMI.

Less Strict Borrowing Requirements

VA loans are designed to make it easier for veterans and their families to purchase a home. The VA offers lenient borrowing requirements that make it easier for veterans to qualify for a loan, including:

- No Minimum Credit Score: VA loans do not require borrowers to have a minimum credit score, making it easier for veterans to qualify for a loan.

- No Down Payment: VA loans do not require a down payment, meaning the borrower can finance up to 100% of the purchase price of the home.

- No Private Mortgage Insurance: VA loans do not require borrowers to pay private mortgage insurance (PMI), which can add hundreds of dollars to the monthly payment.

- Flexible Debt-to-Income Ratio: VA loans are more flexible when it comes to debt-to-income ratio requirements. This allows borrowers with higher debt-to-income ratios to qualify for a loan.

- Lower Interest Rates: VA loans typically offer lower interest rates than other loan types, helping veterans save money over the life of the loan.

Pros of a VA Loan:

- No down payment needed, meaning you can finance up to 100% of the purchase price of the home.

- No private mortgage insurance (PMI) required, saving you money on your monthly payments.

- Lower interest rates than other loan types.

- More flexible debt-to-income ratio requirements, making it easier to qualify for a loan.

- VA loans are assumable, meaning you can transfer the loan to another borrower if you move or sell the home.

Cons of a VA Loan:

- VA loans can only be used to purchase a primary residence.

- VA loans may require a funding fee that can be up to 3.3% of the loan amount.

- VA loans may require a minimum credit score of 620.

- VA loans may have a maximum loan amount that is below the purchase price of the home.

- VA loans may require additional fees such as an appraisal fee or a mortgage origination fee.

The Bottom Line on VA Loans.

Our military veterans have earned the right to enjoy the benefits of a VA loan. As mortgage brokers, it is an honor to serve those who have served our country. Through VA loan programs, we are able to help place military veterans and military families into homes.

These courageous men and women have sacrificed so much for our freedom and safety. They deserve to be rewarded for their hard work and dedication. VA loan programs make it easier for them to purchase homes and secure their financial future. We are proud to be part of the process, helping to ensure that our military veterans are taken care of.

We must remember to honor and appreciate our veterans. They have given us so much and we owe it to them to provide them with the financial security that they deserve. It is truly an honor for us at Forward Loans to assist in this process, and we are grateful to be able to help our military veterans and their families.

Michael Creel is a veteran in the marketing industry, with a proven track record of helping brands in the real estate and lending space build a strong presence across a number of social platforms.

He’s built and implemented several marketing strategies and installed the digital and social framework to support several mortgage teams, loan officers, realtors, multiple new home builders as well as various brands in other spaces.

In 2020 Michael opened Forward Loans, a duly licensed mortgage brokerage, offering digital strategies and marketing automation to loan officers, while focusing on process and service for clients and employees.